Peer-to-peer lending is currently booming, there is no doubt about it. This reasonably young industry is developing by two figures each year in Europe as well as the rest of the world, and it is easy to understand why. As saving accounts and regular banking investments pay reduced returns, p2p lending is an ideal alternative to make more some passive income from your savings.

Grupeer is among the biggest players in the P2P investing industry . This platform hails from Latvia and is among the fastest developing businesses in this crowd lending niche.

Grupeer is a common Peer-to-peer lending platform where one can invest in numerous loans and earn money when people pay the loans back with interest, although it has several twists which make it interesting.

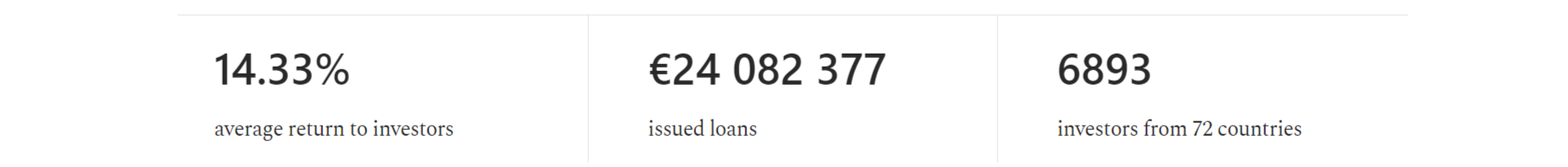

Grupeer P2P investment platform statistics in March, 2019.

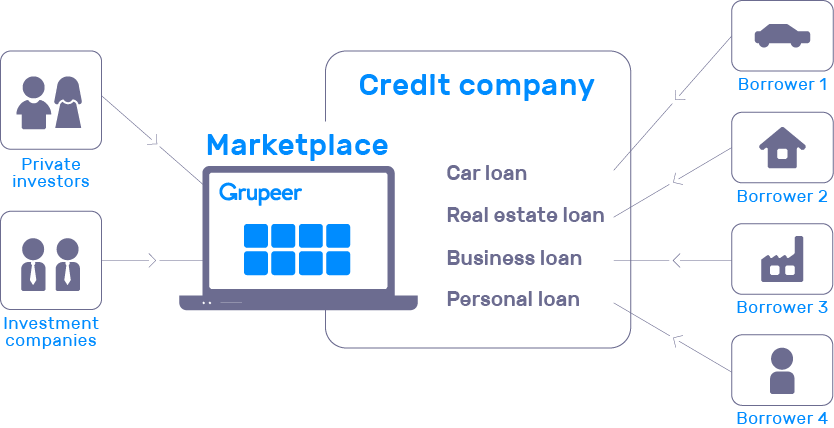

How Grupeer works

Firstly, they blend classical loans (business or personal loans) with real estate investment objects, and it is quite easy to invest in both at one go. This is somewhat different from other platforms which concentrate on one of the two. Investing in real estate development loans is ideal for investors since it offers you extra security to pay back the loan if something goes wrong.

The median yield across every investor is approximately 14%, which is relatively high for a peer-to-peer loan platform. Besides, there are plenty of loans on the platform which come with a buyback guarantee. This means that even though someone does not pay you back, you will get your original investment back. This is what makes it a fantastic platform to invest in since you get high yield as well as an extremely secure investment.

Start investing with Grupeer from only 10 EUR

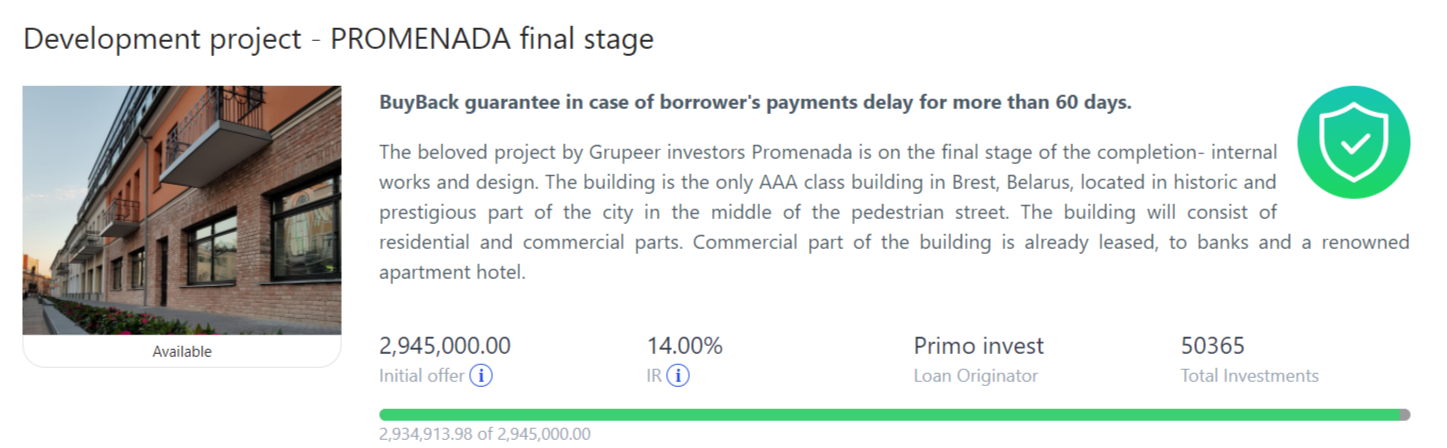

An example of grupeer Development Project

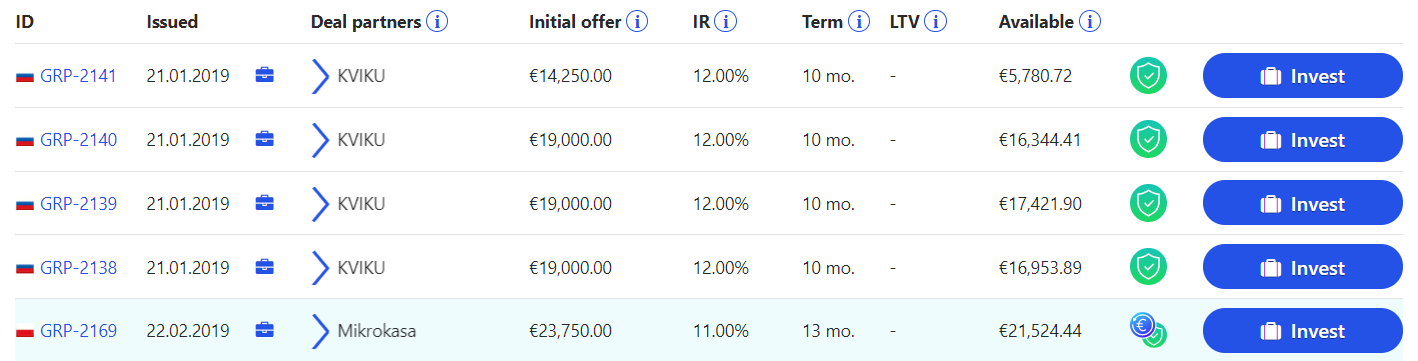

Grupeer short-term loans investment opportunities examples

How to invest money in Grupeer

#1 Open an account

Opening an account on Grupeer is straightforward. You need to enter some of your details and confirm your email. Currently, they are only allowing investors from the European Union. After you are done with the registration procedure, you will see the account balance page.

After this, it is time to put some money on the platform. This is as well very easy since all you require is to do a SEPA transfer to their account. Lately, they have introduced the option to pay through TransferWise; therefore even though you do not use Euros as your primary currency, you can send some funds without losing any money in conversion charges.

Start investing with Grupeer from only 10 EUR

#2 Invest in loans

Now you need to invest in some loans. Check out the loans manually, to view what is available on this platform. You can see those loans immediately which are real estate projects. Most of these loans also have increased yields as well as a buyback guarantee, which is ideal for any investor.

#3 Automating investments

Automating your investments entirely means they will produce 100% passive income. This is an advantage which comes with investing in peer-to-peer loaning platforms which typically offer an automatic investing option. Fortunately, Grupeer also has this feature, so all you need to do is turn it on.

You will have to adjust some settings on the platform, and it will automatically invest in the loans which match your settings. These settings include:

- Loan type – these are usually 5, i.e. business, mortgage, car, development project and personal loans

- Country

- Loan Originator

- Term interval

- Interest rate interval

- Strategy auto-investment limit

- Repayment type

- Maximum amount per project

This is very fast – in less than 5 minutes, their algorithms invest in about ten loans which match your auto-invest settings. Now you have to wait for your funds to be paid back with interests.

Pros of investing with Grupeer

Increased returns – This platform gives up to 15% interest rates and has a 14.25% median return for all investors. This is one of the highest returns on the peer-to-peer loaning market.

Buyback guarantee – In case a client delays or refuses to pay the loan, the buyback guarantee will come in handy. There is a contract between the Grupeer and the Loan originator whereby the latter is obliged to buy back any remaining principal and accrued interest. Besides, if a loan originator neglects this contract, Grupeer will take responsibility, inclusive of the buyback guarantee. Buyback guarantee on this platform is effected after a loan is unpaid by 60 days.

Immediate cash back – Several Grupeer loans are marked using a small blue circle. This indicates cash back on your investment. If you invest in these kinds of loans, the platform pays cash back equal to the stated percentage of your investment to your account directly. This is paid immediately after share purchase and is afterwards available for withdrawal or re-investment

Start investing with Grupeer from only 10 EUR

Cons of investing in Grupeer

The biggest disadvantage of this platform is that it is a new platform – launched in 2017. Since it has not been in the market for long, there is no data on its long-term performance.

This platform prides itself in the absence of unpaid loans, which is ideal. However more historical information would be an advantage. We cannot blame them for being new, but for the time being, it is a disadvantage.

Several features are also missing. For instance, a secondary market would be an advantage for people looking to liquidate their assets fast. This is not available currently, although the Grupeer team is expected to release it soon.

Why is Grupeer unique?

Grupeer gives higher returns together with a buyback guarantee. They offer a wide variety of loans in terms of loan types, geography, which makes it a decent platform to invest in. However, it is also an excellent supplement to existing peer-to-peer loaning platforms, since they offer loans to countries which are not presently covered by most portfolios such as Norway, German and Belarus. Besides, the user interface is quite easy to use and can be swiftly set up and left to generate passive income.

Conclusion

Grupeer is a large p2p lending platform. It has high returns, convenient functionality, detailed loan facts, good diversification probabilities as well as quick client support and this is why it is hard for other portfolios to compete. Certainly, this platform has a few cons, like any other platform, but it remains to be among the best lending platforms available.