Here’s an in-depth review of VIAINVEST and why it’s a good idea to try it out.

What is VIAINVEST?

VIAINVEST is a P2P investing and lending platform that issues loans in Latvia, Poland, Sweden, and the Czech Republic. The platform is part of the VIA SMS group which has issued more than one million loans, and it’s where borrowers ask for loans which then appear on the www.viainvest.com website, where they are open for public financing.

All loans that are displayed on the VIAINVEST platform are already pre-financed, which means that loans will not be returned to you because not enough lenders financed your loan which is pretty cool.

How does VIAINVEST work?

VIAINVEST varies a lot from conventional banking practices. That’s because individual investors are given complete access to the non-banking sector. This is achieved through an easy process.

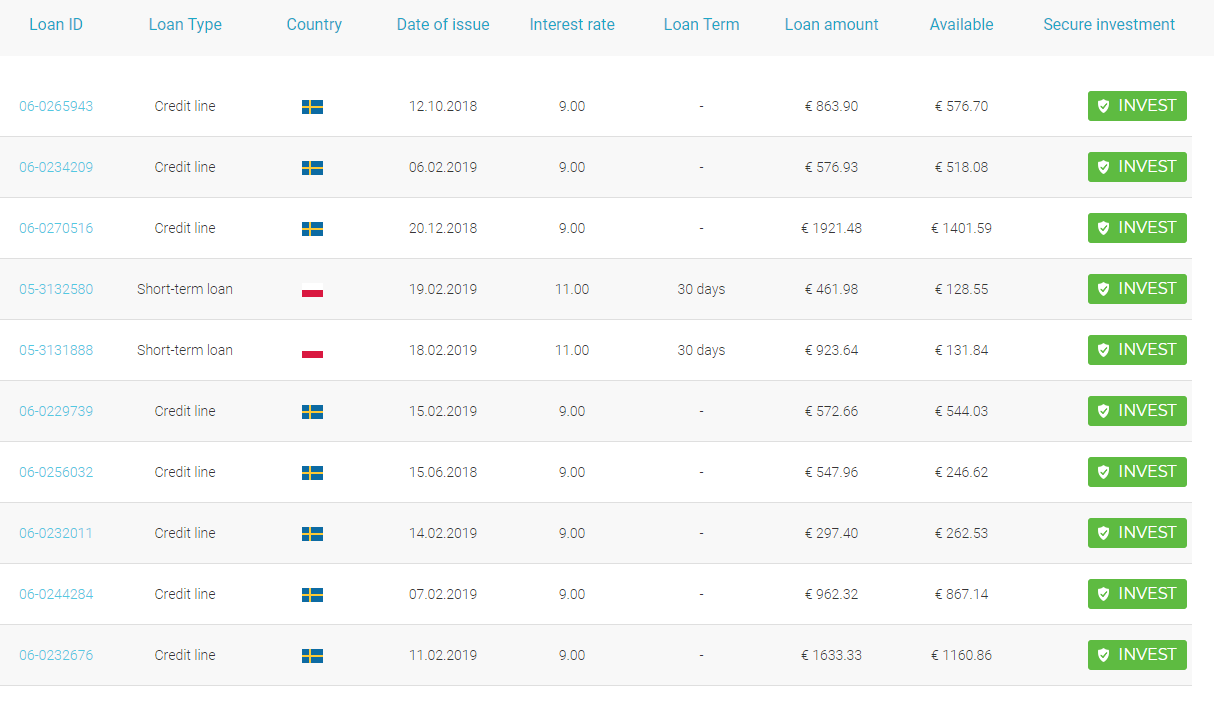

When a borrower requests funds from VIA SMS Group, an active contract will be shown on the platform automatically. The contract will also be available for public investments. Every investor is given full control over how much he wants to finance. VIAINVEST also gives you the chance to choose which loan you want to invest in.

Highlights of the VIAINVEST P2P investing platform

- Investment platform was started in 2016;

- The company’s headquarters is located in Riga, Latvia;

- VIAINVEST has its own loan originators;

- More than 7000 investors have joined;

- All investment loans are pre-funded and with 100 percent buyback guarantee;

- The platform has an average interest rate of 10 percent to 12 percent.

Start investing with VIAINVEST from only 10 EUR

How Do I Sign Up?

If you are interested in investing in peer to peer loans, you can go to their website www.VIAINVEST.com and sign up quickly and easily. There are no specific conditions or requirements needed for anyone to join the platform. It’s available for anyone to join will little trouble.

The signing up process is also straightforward. You just have to fill a traditional sign-up form which is found on many other websites. One thing to mention, that you will be asked to provide the number of your government issued identification document, for example ID card of passport. Otherwise, there are no unusual details that are needed for you to join the platform. You can open your account in just a few minutes and gain access to the platform.

Before you start using the platform, you must also have basic knowledge about internal taxation. This is because you with that knowledge you will be able to use VIAINVEST with no frustration.

Compared to other P2P investing platforms, they actually manage taxes directly from the platform. This is done by withholding taxes directly from all profits earned from the platform. This is done in accordance with the law.It’s important to note that the exact percentage of tax that withheld depends on your county of origin. For example, the tax rate of Poland is different from Sweden’s tax rate. This is why you need to know about taxes in your country if you want to use the platform with little stress.

Who Can Open a Viainvest Account?

Both legal and private entities can open a VIAINVEST platform and become investors. They can then start investing as individuals in VIAINVEST. You must be 18 years old or older for you to sign up and start investing.

What’s the minimum deposit amount?

After opening an account, you can now go ahead and invest in some loans. You, however, need to note that the minimum amount you can invest in is 10 EUR. You, therefore, need to deposit at least 10 Euros to start investing.

There are no additional fees when investing with VIAINVEST — this great for your peace of mind when you’re investing with the platform.

How do you fund your Account

You can add funds directly to your account through a bank transfer. After the transfer, the payment will take up to two days to be processed. Investor Accounts can be opened only in Euros, but VIAINVEST allows deposits in all currencies. VIAINVEST only allows deposits from banks within the European Union. This is mainly used for identification purposes.

Start investing with VIAINVEST from only 10 EUR

Advantages of VIAINVEST

Great Customer relationship

VIAINVEST really values client satisfaction. They also welcome both private and enterprise investors.

Diversification

VIAINVEST strives to blend value creation with security through diversification. P2P investing within the European Union ensures that your funds are protected.

Transparency

VIAINVEST serves as a link between borrowers and investors by giving a platform for secure and genuine financing opportunities. There are also no hidden charges or payments for using viainvest.

Compounding profits

VIAINVEST allows automatic re-investing of profits and refunded principal. This guarantees continuous optimized use of funds and lets you benefit from the power of compound interest. This will allow even small funds to grow into substantial gains.

Buyback guarantee

All loans you decide to invest in have a buyback guarantee. It’s very nice and stress-free to have backed loans. You can pick and invest in any loan since your investment is safe.

Fair returns

All investments in VIAINVEST have 10 percent to 12 percent interest. This is not bad at all, particularly for guaranteed investments.

Most loans are short-term

Most investments in VIAINVEST are for thirty days or less. This gives you a quick return for your capital, and a fast exit is you decide to leave VIAINVEST.

Plenty of loans

There are a lot of loans that appear on the VIAINVEST website every day.

Disadvantages

VIAINVEST has a very basic and poor website

The contents and catalogs are not planned well, and the information shown are not detailed enough. The statistics on the website are also not useful.

Minimum 10 EURO per loan

Although this is the standard for most European Union P2P investment sites, it still a lot especially when you compare to other P2P sites. You will need more money to have good diversification.

Has no secondary market

Secondary markets have a lot of great opportunities that would make VIAINVEST an excellent platform.

Verdict

VIAINVEST is one of the best P2P investment platforms in Europe. I like that all the loans have a buyback guarantee and the platform focuses on short-term loans.

I highly recommend investing on the VIAINVEST platform.

Hi , I do believe this is an excellent blog. I stumbled upon it on Yahoo , i will come back once again. Money and freedom is the best way to change, may you be rich and help other people.

Thank you!

So do you mean you invest your capital to fund loans for people and then the website pays you 10% interest? As if you become a loan provider? How is the website making profit?

Yes, thats right! P2P platfroms make money from commissions that they get from issuing loans. The borrower will have to pay 15% interest – you will get 10% and the platform will keep 5% to cover their expenses and make profit. That is how it works.