I am always curious whenever I come across an opportunity to make money on the internet. I like to make wise investment decisions and this is the main reason why I do research before making investment. I came across Lenndy as I was going through the various P2P money making opportunities.

What is Lenndy?

Lenndy is a Peer-to-Peer (P2P) lending platform which gives people an opportunity to make money conveniently. On this platform loan originators list different kinds of loans in which investors can invest their money to make profits from their invested money. This platform was started in 2016 and since then it has grown significantly. Currently the platform has more than 4500 registered investors and more than 5500 loans have been funded. The country of operation for this platform is Latvia and it gives people from different parts of the world opportunity to earn profits.

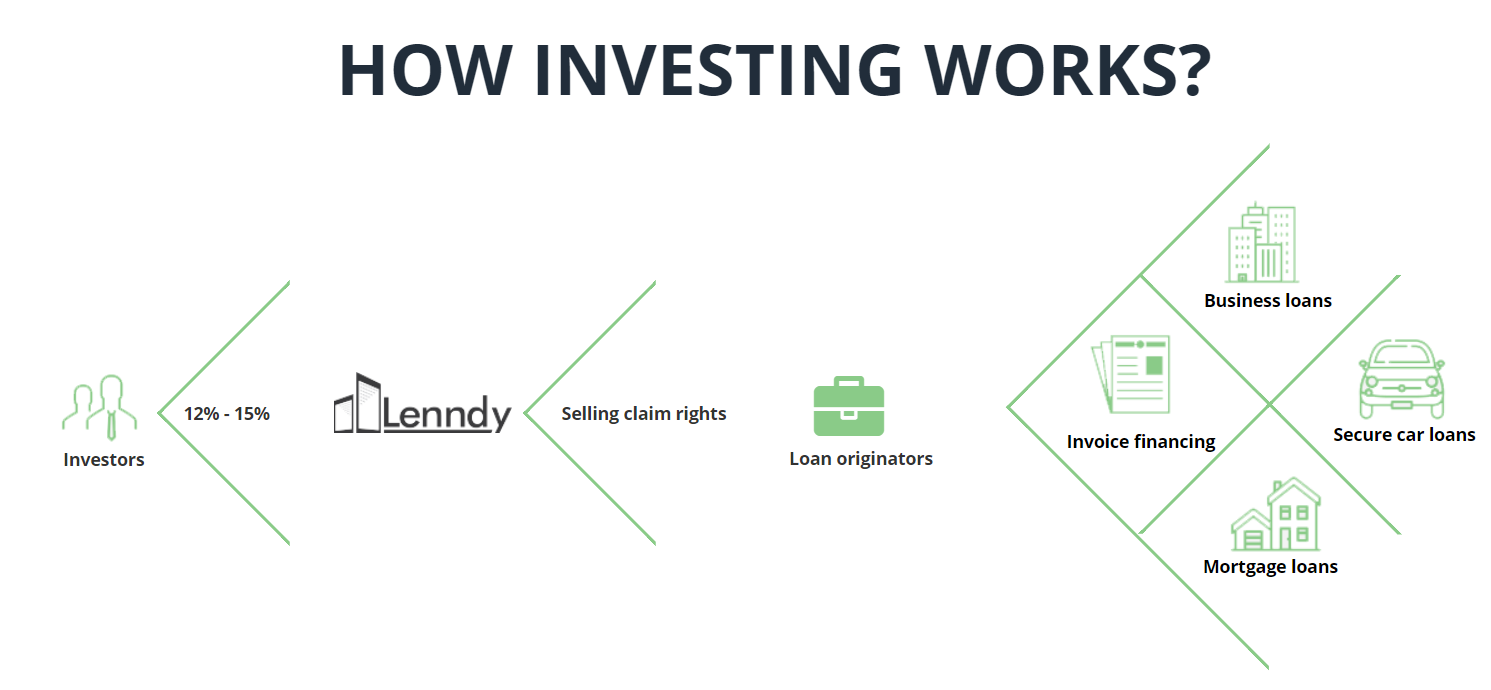

The loans available on this platform include:

• Mortgage loans which are business loans with pledged real estate;

• Invoice financing;

• Business loans;

• Secured car loans;

• Consumer loans.

Start investing in P2P with Lenndy from only 10 EUR

How it Works

This peer to peer investment platform works in a simple and straight forward way. The platform allows loan originators to list the loans that they might have for the investors to select the ones they prefer. When an investor gets into the website he or she gets to choose the preferred loan from the ones that are listed. After investing on a chosen loan the money is paid back after the agreed time together with interest. This interest is what the investors gain from investing on this platform. Since there are different types of loans the investors are encouraged to diversify their investments. This is to reduce the risks and to make sure that they can make money from the various loans that are available. The annual returns range from 12% to 15% with the average returns being about 12.47%.

Majority of the loans that are listed on Lenndy have buyback guarantee and/or pledged collateral which is provided by the loan originators. This means that if the borrower is overdue for more than sixty days, the loans are purchased by the loan originators together with the accrued interest. From the website one can see the loans that come with money buy guarantee. This feature is mainly meant to ensure that the investors do not lose any of their investment no matter what.

The Steps of Investing

Investing on this P2P platform is simple and can be done by almost anyone. The first step involves getting into the official website and opening an account. To open an account one just needs to provide a few basic details such as name and address. One then needs to transfer the money to be invested to the account with the minimum amount that can be invested being 10 EUR. The platform accepts different currencies but if the currency is not EUR it is changed into EUR depending on the current exchange rates.

When the money is safely into the account one just needs to choose the loan preferred from the ones available. One needs to check the various conditions of the loans prior to investing. After deciding which is most ideal the next step is just investing the money. The platform takes between one to fifteen days for the money to be invested.

There is also the auto invest option which allows the system to invest automatically for the investors. As an investor one is just required to choose the preferred investment strategy. The system will follow the investment strategy chosen once there is an investment opportunity. This is helpful because it helps save time since one does not have to keep on checking whether there are ideal investment opportunities. One can easily turn off the auto invest option at any time depending on preferences. Investors also have the options of selling their investments on a secondary market. This is especially ideal for the investors who would like to liquidate their assets quickly.

Start investing in P2P with Lenndy from only 10 EUR

Review of Lenndy website

Lenndy has a very interactive and friendly website which has almost all the details that the investors might need. This website is mobile compatible which allows users to access it even through their mobile devices. All the details on the website are arranged in a way that investors can navigate easily. Despite the high number of investors the website is fast where there are no unnecessary delays. One can also get information from the support team which is easily available. The members of the support team are well informed and as a result they can answer almost any question. This is helpful especially to new investors who might have questions. It is also helpful to people who might have issues where the support team ensures all the issues are resolved within the shortest time possible.

Pros

• The loans are secured by buyback guarantee;

• The default rate on this platform is zero;

• The lender return rates are high where they are higher than most other P2P platforms;

• The process of investing is simple and almost anyone can be able to implement it;

• A lot of loans have already been funded which shows is a reliable platform.

Cons

• Funds are only accepted through Payserra accounts;

• Id verification takes a relatively long time.

Final Verdict

From this Lenndy review it is evident that this is a reliable platform when it comes to P2P investing. For the last two years, while the platform has been operating a lot of investors has received lucrative returns from their investments. The number of investors has also been growing steadily, and this fact shows that more people have confidence in this platform. Even investors who do not have a lot of money can invest on this platform since the minimum amount one can invest is just 10 EUR. There is also a very reliable support team that is always ready to answer any issue that might be there.

Lenndy Peer to Peer Investment Platform is a good choice if you are looking for trusted investment opportunity.