Are you worried about inflation?

Would you like your savings to earn money every day?

Would you like to earn money even when you sleep?

Your answer to all these questions is probably “Yes”.

I’m also concerned about inflation and I want my savings to earn money, so I’m looking for ways to make them earn money.

And I have found probably the easiest and most profitable way – Monefit SmartSaver.

Monefit Review

Monefit is owned by Creditstar Group, a recognized financial services provider with more than ten years of experience in the market. With operations in several European countries, Creditstar has built a solid reputation for offering short-term and installment loans to customers and has secured more than 83 million returns for its customers.

Credistar Group is a prominent and proven European lending group offering loans across Europe and operating in countries such as Spain, Great Britain, Sweden, Denmark, Poland, Czech Republic, Estonia and Finland.

Monefit offers a product called Monefit SmartSaver designed to help everyone achieve their financial goals by providing 7% annual interest (compound interest) on invested savings. This product is designed for those looking for an alternative to traditional savings accounts that offer very low returns.

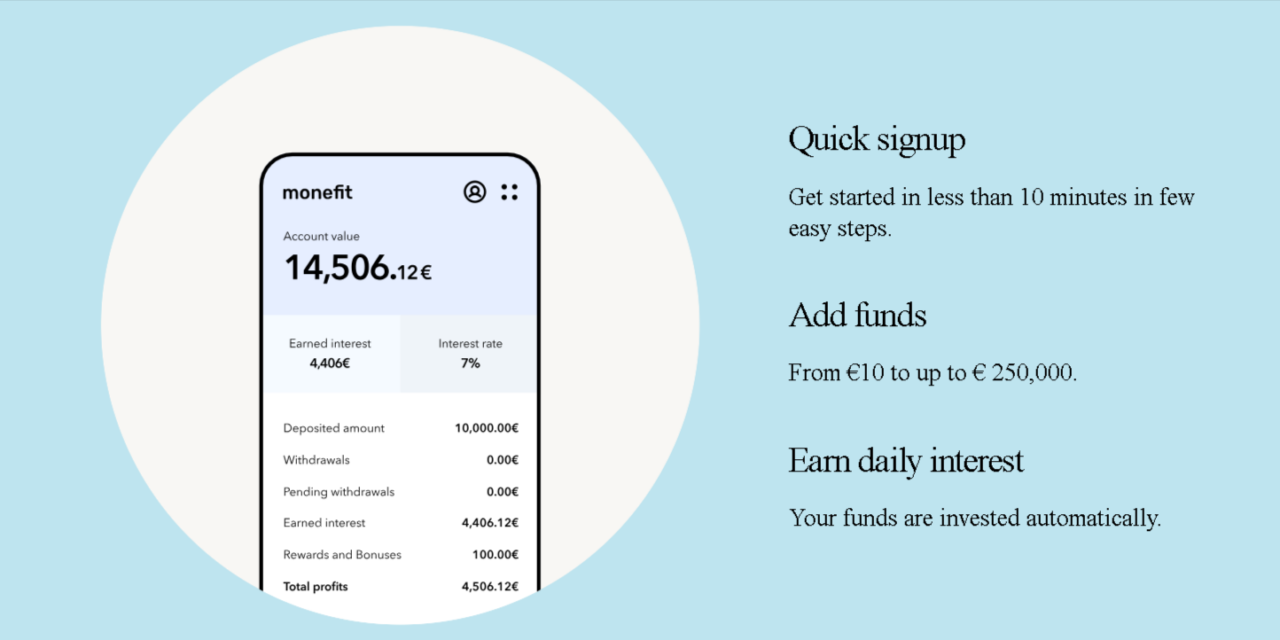

How does Monefit Smartsaver work?

- Quick registration – start investing in less than 10 minutes by completing the standard registration procedure.

- Add funds – from 10 euros to 100,000 euros.

- Earn interest every day – Your funds are automatically invested at 7.25% compound annual interest rate.

- Withdraw money at any time – Your invested money is not blocked for a certain period of time. Instead, you can withdraw money at any time and your money will be in your bank account within 10 working days.

Investing with Monefit is amazingly easy! Make a deposit and your funds will automatically and immediately start earning interest!

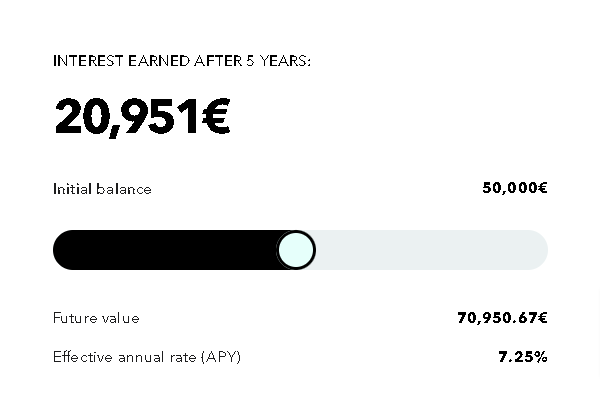

Investment calculator

By entering the Monefit website, you will be able to “play” with the investment calculator. This is a very interesting tool that will allow you to see how your invested funds will grow over the next five years.

In this example, we can see that if we invest 50,000 euros now, after five years we would have 70,950 euros. The invested 50 thousand euros would have earned almost 21 thousand euros in five years!

What rate of return can you expect?

According to Monefit, the fixed return is 7.25%.

Compared to other well-known P2P lending platforms such as VIAINVEST and Mintos, Monefit’s average return rate of 7.25% is very low. But compared to a savings account, the returns are quite high, but you also take more risk.

While Monefit advertises a 7% return on investment in its product, this return may fluctuate as stated in the platform’s terms and conditions. This is probably due to the fact that market conditions can affect a company’s profits.

Monefit reviews

Monefit Trustpilot reviews:

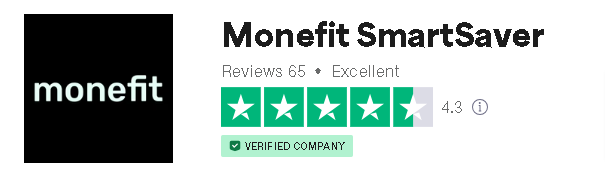

Monefit has an excellent rating on Trustpilot. The platform has over 50 reviews and is rated 4.3/5 stars.

Compared to other P2P lending platforms, Monefit has a pretty good rating on Trustpilot.

Positive reviews mention decent interest and excellent customer service. Some of the negative reviews are from investors located in countries where the platform is not allowed.

With over 60 positive reviews, Monefit is worth considering as an alternative to a savings account.

Questions and answers

How safe is Monefit?

Security is one of the most important factors to consider when investing money online through P2P lending sites.

Lender’s risk

When you invest your money in Monefit, you are essentially lending your money. This is where the loan originator puts the risk on you as an investor. If they are not in control of their finances or business processes, your money is at stake.

How stable is the company?

Monefit is a new P2P lending platform from 2022 and there is not much financial data about the company yet. Therefore, it is difficult to assess how stable the platform is at this time. However, since Monefit is owned by Creditstar Group, a profitable lending group founded in 2006, the platform has some credibility.

Summary of Monefit SmartSaver

Monefit SmartSaver offers an attractive option for anyone looking for a user-friendly and affordable P2P investment platform. The simplified approach to investments and the high annual interest rate – 7.25% distinguish it from traditional savings accounts.

The platform’s automatic investment feature without freezing money further enhances Monefit’s appeal to those who want to flexibly manage their investments and savings.

A lower rate of return suggests a less risky investment approach, but may not be as attractive to experienced P2P investors looking for higher returns on their investments.